%2017_10_18-E3.jpg)

Kuwait: NBK 2018 Walkathon Centre starts receiving applicants

29.11.2018National Bank of Kuwait (NBK) opened a specialized center in the Green Island to assist the registered participants in its annual walkathon and distribute the assigned T-shirts and numbers. The center will be opened daily until December the 6th, 2018 from 1:00 pm to 09:00 pm.

This year, NBK's Walkathon is marked by a variety of fun, entertaining and health awareness-raising activities. Titled “We’re stronger… with every step”, the Walkathon will take place on the 8th of December 2018. NBK will be giving away two new Nissan cars from Al Babtain Group during the Walkathon along with many other valuable prizes.

Participants of the age12 and above who registered online can now visit NBK walkathon center daily until December the 6th, 2018 to receive their assigned T-shirt and number. Children between the age of 5 and 11 are welcomed to receive their kits at the center. Children’s activities will be organized by CIRCUIT+ during the day of the race at Shuwaikh Beach Park from 9 am until 12 pm.

Ten winners will be selected from each of the 10 categories of participants. The walk for both the female and male participants will start from the Green Island on the Gulf Road to the Shuwaikh Beach Park, parallel to the Gulf Road, next to KPC building for a distance of 11 Km.

NBK strongly supports sporting events and encourages various sporting activities as means to promote a healthier and more active lifestyle for members of the community. Throughout the years, NBK also organizes several social awareness programs including Educational, Environmental, Health and many other active initiatives.

Kuwait: NBK Celebrates the Graduation of the First Wave of “NBK Tech Academy”

23.04.2024National Bank of Kuwait (NBK) celebrated the Graduation of the first wave of “NBK Tech Academy”, the first of its kind Academy in Kuwait focusing on digital and data technologies,

The graduation ceremony was attended by Ms. Shaikha Al-Bahar, Deputy Group CEO of NBK, Mr. Mohamed Al-Othman, CEO - Consumer and Digital Banking Group, Mr. Mohammad Al-Kharafi, COO - Head of Group Operations and Information Technology, and Mr. Emad Al-Ablani, GM – head of Group Human Resources.

The Academy’s program lasted for 7 months during which 10 participants received intensive training covering technical skills for advancing their careers including, but not limited to: FinTech, Data Analytics, Ethics in Technology, Cyber Security, Fundamentals of Digital Payments, Digital Innovation, Artificial Intelligence, Scripting and Programming, Fundamentals of Codifications, and Finance for Non-Finance Professionals.

In addition to technical skills, the program also focuses on developing soft skills including, but not limited to: Teamwork and Team Building, Business Planning and Business Analysis, Writing Skills, Delivering Results, Meeting Customer Expectation and Customer Centricity, Presentation Skills, Productivity in the Workplace, Business Ethics, Principles and Values, Learning and Researching, Project and Change Management, and Customer Experience.

The participants were split into teams, each assigned an expert coach from NBK, and were challenged to come up with a new idea or enhanced process that would serve the bank, and the winner was selected at the end of the program.

On this occasion, Mr. Emad Al-Ablani, GM – Group Human Resources at National Bank of Kuwait, said: “We are glad to graduate the first wave of NBK Tech Academy, which aims to foster digital talent and enhance expertise in technologies, as we realize the importance of developing the digital community within the bank, being instrumental to strengthen active digital capabilities and promote interaction with content and events aiming to drive continuous innovation.”

“NBK upholds an unwavering commitment to investing in national talent, as we always focus on providing the Kuwaiti youth with the best-in-class and most advanced training programs as per the highest international standards, with the aim of preparing a generation of highly skilled bankers across all fields, especially digital technologies that have become imperative in view of the advancement in banking using cutting-edge technologies and AI,” he added.

“NBK Tech Academy embodies NBK’s vision and keenness to keep up with the accelerating needs of the digital era, and its understanding of the importance of nurturing and developing high-caliber talent in areas like MIS, Information Security, Data Science, and Computer Science,” he noted.

Al-Ablani continued: “Kuwait has a talented and promising generation who possess professional skills and capabilities in technologies and digitization, and NBK is firmly committed to training and qualifying them for the labor market, in preparation for transformations dominated by AI, robotics and data science.”

“NBK seeks to be an active contributor to the development journey of this generation of the Kuwaiti youth and to provide optimal guidance for their capabilities,” he explained.

NBK continues to solidify its leadership in the private sector in terms of attracting, training, upskilling national talent and qualifying them to join the banking sector. The bank also stands out as the employer of choice for national professionals, with the highest Kuwaitization and employee retention ratios across the private sector.

NBK Tech Academy is part of the NBK Academy running for 15 years now, as it was established in 2008, and graduated 28 successful waves who have become active members of the bank’s professional team, having been qualified through the Academy to join the banking sector.

Kuwait: NBK Announces the First Winner of Al Jawhara Grand Prize Worth KD 1 Million for 2024

23.04.2024Amidst festive atmospheres and remarkable audience, National Bank of Kuwait (NBK) held a special event l Friday at the 360 Mall, which extended for more than 3 hours and featured a variety of highly engaging activities, marking the announcement of the first draws of Al Jawhara and Al Jawhara Junior grand prizes for 2024.

The event was attended by a number of NBK executive leaders and officials where the draw, which was conducted in the presence and oversight of a representative of the Ministry of Commerce and Industry, as well as a representative of Deloitte, revealed Al Jawhara Account holder Abdullatif Saad Abdullatif Al Dosary as the lucky winner of the KD 1 million prize, making him the first millionaire in Al Jawhara Account for this year. In addition, Al Jawhara Junior Account holder Fatima Mohammed Abdulwahab Al Zalzalah was announced as the winner of the grand prize worth KD 10,000. The grand prize draws for both Al Jawhara and Al Jawhara Junior Accounts is conducted 3 times a year.

The event of announcing the winners featured many engaging entertainment activities and games for children and adults, in addition to the Gergasha comedy show for children. It also included a number of competitions and draws on valuable prizes for the audience , including complimentary one night stay at the Waldorf with spa & restaurant vouchers, in addition to McLaren driving experience for a full weekend, and a free yacht trip for 6 hours to enjoy wonderful moments with friends and family.

The event also hosted many booths showcasing NBK’s premium offerings for Private and Privilege Banking Customers.

Savings culture and financial inclusion

Commenting on this occasion, Mr. Mohammed Al-Othman, CEO-Consumer and Digital Banking at National Bank of Kuwait said, “Today, we are pleased to celebrate the announcement of the first millionaire in Al Jawhara grand prize draws for this year, as well as the winner of Al Jawhara Junior grand prize. These prizes come within our customer rewarding strategy, while Al Jawhara Account serves as a key tool for promoting a culture of savings and financial inclusion.”

“NBK always seeks to deliver a top-notch banking experience for its customers, integrating the best products and services with a package of exclusive, unmatched benefits and rewards. To this end, the bank has increased the total amount of the Al Jawhara Account prizes to KD 5 million starting this year,” he added.

“Seeking to elevate the benefits and rewards provided to Al Jawhara Account holders, NBK always strives to introduced valuable offerings including Al Jawhara Junior Draws for Al Jawhara Account holders below the age of 21 with 7 winners of monthly draws (KD 1,000 for 3 winners and KD 500 for 4 winners) in addition to 1 winner of KD 10,000 prize with each grand prize draw,” he mentioned.

“Furthermore, NBK provides the new exclusive Al Jawhara Saver Account, offering customers a bonus interest rate up to 1.5% for the first year, in addition to the chance to enter the monthly and grand draws if savings reach KD 5,000 and above. The bank is also offering customers who have been banking with it for more than 2 years double chances in case they were not eligible to earn the existing double chances,” he explained.

NBK has already increased Al Jawhara prizes by more than the double in early 2023, making it the biggest in Kuwait, with KD 20,000 prize weekly, KD 125,000 monthly, and grand prizes worth KD 1,000,000 each, three times a year.

Kuwait: NBK Reports KD 146.6 Million in Net Profits for 1Q2024

23.04.2024National Bank of Kuwait (NBK) has announced its financial results for the three-month period ended 31 March 2024.The Bank reported a net profit of KD 146.6 million (USD 476.8 million), compared to KD 134.2 million (USD 436.6 million) for the corresponding period in 2023, improving by 9.2% year-on-year.

Total assets as of the end of March 2024 grew by 5.1% year-on-year to reach KD 38.3 billion (USD 124.7 billion), whereas total loans and advances increased by 5.7% year-on-year to KD 22.4 billion (USD 72.8 billion), while shareholders’ equity reached KD 3.8 billion (USD 12.3 billion), growing by 7.9% year-on-year.

Commenting on the Bank’s 1Q2024 financial results, Hamad Al-Bahar, NBK Group Chairman, said: “In the first quarter of 2024, we recorded robust profits, showcasing our commitment to delivering long-term sustainable value to our customers, community, and shareholders.”

“As we continue to capitalize on our strategic investments in technology and talent, we remain confident in our ability to achieve further successes in meeting the needs of our customers,” Al-Bahar confirmed.

Al-Bahar emphasized that NBK's ongoing success is built upon solid foundations underpinned by diversification, a key pillar of its strategy. He underscored that strategically diversifying the Bank's portfolio and services across different geographic regions not only mitigates risks but also capitalizes on favorable prospects. This underscores NBK's commitment to adaptability, resilience, and ensuring enduring stability over the long term.

“Kuwait's economy displays resilience and stability, firmly rooted in robust foundations. We expect an uptick in activity within Kuwait's operational scene throughout 2024, resulting in increased project awards and reinforcing trust in the country's business landscape,” Al-Bahar added.

“In spite of the recent escalation in geopolitical tensions in the region, we continue to focus on advancing our operations in the markets we serve while closely monitoring the repercussions on the operating environment in the region,” Al-Bahar explained.

He emphasized that in 2024, NBK maintained its dedication to executing a multitude of impactful initiatives, further solidifying its position as a frontrunner in community development within Kuwait. Simultaneously, these endeavors upheld responsible business practices and played a role in fostering the sustainable advancement of the local economy.

Meanwhile, Mr. Isam J. Al-Sager, NBK Group Vice Chairman and CEO, said: “We have had a strong beginning to 2024, with our business segments maintaining momentum throughout the quarter. This underscores the benefits of our strategic investments and diversified business portfolio.”

Al-Sager highlighted the Bank's robust performance, citing strong revenue and profit growth. He noted that the operational momentum from 2023 carried forward into the current period, resulting in another quarter of strong profits fueled by growth across all business sectors.

“The Group's net operating income increased by 11.2% year-on-year, reaching KD 309.0 million (USD 1.0 billion). This increase was fueled by improved revenues across various business sectors, reflecting the diverse and multiple sources of income within the Group,” Al-Sager added.

Al- Sager stressed that the domestic political environment witnessed some recent instability in the form of changes in parliament and government. This is likely to result in the postponement of the long-awaited investment opportunities in Kuwait. He expressed his hopes of an improved and more stable political landscape going forward; which should positively reflect on the business environment domestically.

Sustainable Growth

Al-Sager highlighted that NBK’s results underscore the success of its strategy in achieving sustainable growth while also delivering long-term value to its shareholders.

He emphasized that the Bank, buoyed by the robustness of its balance sheet and its diversified business model, achieved business volume growth by prioritizing customer-centric approaches and delivering innovative banking experiences.

“We are seeing considerable momentum in both attracting and developing relationships with our clients. This is further supported by our strong position in terms of credit quality and capitalization, providing us with a solid foundation. This positions us well to continue advancing throughout 2024. Our growth strategy and diversified business mix highlight our resilience and stability amid a challenging macroeconomic landscape,” Al-Sager noted.

Al-Sager emphasized the importance of prudent risk management, alongside adequate liquidity, and robust capitalization, which enabled the Bank to maintain its support for customers and achieve a strong performance in the quarter. He emphasized that financial prudence, combined with ongoing investment in innovation and development, reflects the Bank's commitment to supporting customers and the community, especially in challenging times.

He underscored that in 2024, NBK will capitalize on its robust position to advance its goal of extending its brand presence across diverse sectors, notably in wealth management. This encompasses the launch of “NBK Wealth”, aimed at pioneering innovative and advanced solutions in private banking, wealth management, financial planning, investment management, and advisory services through a global network of operations.

Al-Sager also emphasized the significant strides the Bank has made in its digital transformation journey, focusing on enhancing the banking experience to meet the actual needs and aspirations of its customers. This has been achieved through the design and implementation of a range of digital services and products.

Regional Leadership

“In the first quarter of the year, NBK’s regional leadership in sustainability was acknowledged, culminating in receiving the Best Bank in the Middle East for ESG-Related Loans Award 2024 by Global Finance. This accolade underscores our dedication to sustainable business practices and strengthens our aspiration to serve as the key partner for our clients in sustainable financing endeavors,” Al-Sager noted.

Al-Sager also stated that NBK has received a score of “C” in the categories of Climate Change and Forests 2023, as announced by CDP, a globally recognized non-profit organization overseeing the leading environmental disclosure, noting that NBK stands out as the sole bank in Kuwait to be rated by CDP, establishing its position among the leading financial institutions in the GCC engaged in the initiative.

Al-Sager underscored that in 2024, NBK will continue strengthening its position through investing in its people. The Bank will also prioritize offering the best products and services tailored to its customers' needs, expanding its presence in existing markets, and further developing its innovative businesses to better serve its customers and community.

Key financial indicators for 1Q2024

• Net operating income of KD 309.0 million (USD 1.0 billion), up 11.2% year-on-year

• Total assets increased by 5.1% year-on-year, at KD 38.3 billion (USD 124.7 billion)

• Total loans and advances grew by 5.7% year-on-year to KD 22.4 billion (USD 72.8 billion)

• Customer deposits increased by 9.0% by the end of March 2024 to KD 22.3 billion (USD 72.4 billion)

• Shareholders’ equity amounted to KD 3.8 billion (USD 12.3 billion), registering an annual growth of 7.9%.

• Strong asset quality metrics, with NPL/gross loans ratio at 1.51% and an NPL coverage ratio of 248%.

• Robust Capital Adequacy Ratio of 17.2%, comfortably in excess of regulatory requirements.

Kuwait: NBK Complements Its Ramadan Calendar with Engaging Content on Social Media

23.04.2024National Bank of Kuwait (NBK)’s social media platforms have succeeded in playing a powerful role in increasing interaction of a wide segment of the public in Kuwait with the bank’s distinguished Ramadan calendar aiming to strengthen its relationship with society. The bank utilized its social media accounts to showcase its various activities and volunteering initiatives during Ramadan, as part of its annual philanthropic program, “Do Good Deeds in Ramadan”, embodying its CSR commitment and dedication to deliver its deeply rooted mission of serving the society.

Throughout Ramadan, NBK provided active coverage of the different events, activities and initiatives implemented through the month on all its social media platforms.

Iftar meals, dates and water

These initiatives included providing Iftar meals, dates and water, as volunteers from NBK employees made extensive field trips to distribute thousands of breakfast meals in many areas of Kuwait during Ramadan, in addition to visiting many entities to share breakfast meals with their employees. Like every year, volunteers from different NBK branches distributed dates and water before Iftar time at different areas in Kuwait, to reduce traffic accidents that may occur due to overspeeding to get to their destination by the Iftar time.

Promoting sustainability

Following its annual practice, NBK organized a campaign to promote sustainable practices in collaboration with “Omniya” initiative to collect plastic water bottles from 280 mosques in Kuwait for recycling, thus saving space in landfills. This helps reduce the negative effects of this waste on the environment and health, as the biodegradation of plastic is a slow, long process that may take hundreds of years.

Unique content and duaa videos

During Ramadan, NBK also generated unique content with celebrities and influencers to leverage TikTok and Instagram to reach a larger audience.

The bank also shared duaa videos in a fast-paced, visually captivating manner designed by Kuwaiti photographer Faisal Al-Karam that resonated well on social media.

Competitions and prizes

During Ramadan, NBK utilized social media engagement to host competitions aimed at boosting follower participation, ultimately increasing engagement and potential customer loyalty during the holy month.

The total engagement in these competitions exceeded half a million, with cash prizes ranging from KD 50 to KD 250.

Ranking first in promoting banking awareness

Throughout Ramadan, NBK implemented various fraud prevention measures to keep customers’ accounts and money safe, such as raising awareness about common scams and providing tips for online and offline security.

NBK covered various topics in terms of fraud protection for customers, including secure online banking practices, how to detect phishing emails and scams, the importance of safeguarding personal information, and how to report any suspicious activity. The bank also provided tips on how to keep account information and financial details safe to prevent fraud and identity theft. It also hosted Q&A initiatives to test customer/non-customer knowledge on fraud related situations.

Additionally, recognizing its efforts to promote the “Let’s Be Aware” banking awareness Campaign launched by Central Bank of Kuwait in KBA and local banks, NBK ranked first among all banks in Kuwait, further demonstrating its commitment to ensuring the safety and security of customers’ financial transactions.

Overall, NBK is committed to educating and equipping customers with the necessary tools to stay protected against potential fraud threats, especially in a busy time such as Ramadan.

Innovative interactive presentations

Commenting on the activities and initiatives covered on social media platforms during Ramadan, Abdul-Mohsen Al-Rushaid, AGM, Head of Digital Communications at National Bank of Kuwait said, “NBK always seeks to strengthen its presence on social media during different occasions and seasons all year round by introducing innovative interactive presentations, and covering all events organized by the bank to reach the largest audience.”

“Our social media provide a large platform to interact with customers, including updating them with the latest offers, responding to their inquiries, and fulfilling their needs, while providing them with the latest news and developments related to the bank and its business on a regular basis,” he noted.

It is worth mentioning that by the end of 2023, NBK continued to lead the social media scene among all banks in Kuwait, whether in terms of the number of followers, interaction and engagement across all platforms.

By the end of last year, the total number of followers of NBK’s social media accounts exceeded 2.2 million, whereas it received 3.2 million interactions and increased the number of followers by 160,000 on all platforms including Instagram, X, Facebook, TikTok and YouTube.

Kuwait: NBK Launches “NBK 247 Cashback Visa Platinum Prepaid Card ” with up to 24% Cashback

23.04.2024National Bank of Kuwait (NBK) always seeks to reward its customers and ensure providing them with innovative products serving their needs and enhancing their banking experience. In this context, the bank has launched the new NBK 247 Cashback Visa Platinum Prepaid Card offering customers up to 24% cashback on their daily purchases.

Customers will be able to transfer their daily spends from their debit card to the new prepaid card to get cashback of 24% on streaming services (Payment should be done through the streaming app or website and not through any other service provider), 7% on Food delivery (food delivery applications, it doesn’t include ordering directly from the restaurant), 4% on Bill payments (Telecom bills that are paid through the app or website of the telecom companies or through any of their branches, and not through any service provider), 2% on Grocery, 2% on Hospitals, clinics and pharmacies and 0.7% on Digital payments (made using digital wallets).

One of the first 1,000 customers to apply for the card will get the opportunity to meet the beloved star Mohamed Salah. Noting that date and place to meet the star will be confirmed later on by the bank.

Customers can apply for the card through NBK Mobile Banking App and once they enroll the card in the digital wallet, they will be able to use the card immediately. Now and for the first time, customers will have the option of using a digital card or choosing to issue a physical card.

Speaking on the new card, Mr. Mohammed Al-Othman, CEO-Consumer and Digital Banking at National Bank of Kuwait said, “At NBK, we always strive to provide our customers with new products tailored to their needs. As the name suggests, the newly introduced NBK 247 Cashback Visa Platinum Prepaid Card will be customers’ companion 24/7, giving them valuable cashback on their daily purchases.”

“The new card launch comes within NBK’s consistent endeavors to be always closer to its customers and to serve all their banking needs through unmatched products providing the best benefits,” he noted.

“We also wanted to provide customers with the unique opportunity to meet global icon Mohamed Salah who is loved worldwide, being one of the best soccer players of his generation, with unprecedented achievements over the span of his career,” he added.

"We're delighted to partner with NBK to reward their Visa cardholders with innovative products that meet their needs and enhance their payment experience. The launch of the NBK 247 Cashback Visa Platinum Prepaid Card is a prime example of this commitment," said Mohamed Reyad, Visa's Head of Financial Institutions in Kuwait.

NBK provides an array of prepaid cards which offer numerous benefits, while helping customers spend their money confidently and conveniently, making sure they never go over their budget.

Kuwait: NBK Offers Customers Exclusive Prizes for Paris Olympics, Courtesy of VISA

22.04.2024National Bank of Kuwait (NBK) always seeks to enhance customer banking experience by providing premium exclusive offers and rewards for a comprehensive and exceptional banking experience. In this context, the bank has announced the launch of “2024 Summer Olympics in Paris” Campaign, giving customers the opportunity to win exclusive packages to attend the 33rd Summer Olympics in Paris scheduled from 26 July to 11 August 2024.

The campaign will run from 1 April to 31 May 2024, and a draw will be conducted on 6 June to announce 9 winners who will attend the Summer Olympics in Paris.

Packages will include business class tickets along with a companion, as well as luxurious hotel accommodation, city experience, and tickets to attend the activities including the opening and closing ceremonies.

To qualify for the campaign, customers need to register using the registration page on nbk.com and spend a minimum of KD 250 per month using the eligible NBK Visa Credit/Prepaid Cards. Each KD 1 spent locally gives customers 1 chance, each KD 1 spent internationally gives customers 2 chances, and if the card is issued during the campaign period, this gives customers 10 chances in the draw.

Eligible cards:

• NBK Visa Platinum Credit Card

• NBK Visa Signature Credit Card

• NBK Visa Infinite Credit Card

• NBK KWT Visa Infinite Credit Card

• NBK Visa Infinite Privilege Credit Card

• NBK-KPC Visa Infinite Credit Card

• NBK-Kuwait Airways (Oasis Club) Visa Signature Credit Card

• NBK-Kuwait Airways (Oasis Club) Visa Infinite Credit Card

• NBK-Kuwait Airways (Oasis Club) Visa Platinum Prepaid Card

• NBK Avios Visa Signature Prepaid Card

Commenting on this offer, Anwar Al Ballam Senior Products Manager, at Consumer Banking Group, at National Bank of Kuwait said: “We seek to be always closer to our customers by participating with them in all events and occasions and providing premium offers and exceptional campaigns to meet their expectations and needs, giving them a comprehensive and exceptional banking experience that suits all segments and ages.”

“The exclusive outstanding offers provided to our customers around the year reflect our endeavors to offer them an integrated banking experience integrated with our cutting-edge, innovative banking products, services and payment solutions,” he added.

“NBK Credit Cardholders get the chance to participate in the bank’s campaigns all year round, in addition to enjoying a unique lifestyle through the various benefits offered by these cards,” he emphasized.

“Our Olympics sponsorship enables Visa to co-create with our bank partners worldwide exclusive experiences for our cardholders. That’s exactly what this partnership with NBK is about - helping make Visa cardholders’ journey to 2024 Summer Olympics in Paris a memorable one. This promotion is also a great way to support the Kuwait government’s ambitions to extend the benefits of digital payments to more local consumers and businesses. We are delighted to partner with NBK on this exciting promotion and look forward to bringing more of these exciting promotions to Visa cardholders in Kuwait,” said Mohamed Reyad, Visa’s Head of Financial Institutions for Kuwait.

NBK Visa Credit Cards offer the best payment method for the convenience and benefits they provide to customers, especially when using them in shopping including NBK Rewards Program, NBK Miles Program, as well as Purchase Protection and Extended Warranty.

Additionally, NBK Visa Credit Cards provide a unique lifestyle, and eligibility for exceptional campaigns throughout the year, which are always well-received and popular among customers.

Kuwait: NBK Sponsors Specialized Training for Kuwaiti Medical Team Heading to Gaza

21.04.2024Over a period of five days, National Bank of Kuwait (NBK) sponsored and hosted specialized medical training courses conducted by UK-based charity David Nott Foundation, in collaboration with Kuwait Red Crescent Society (KRCS). The courses involved the participation of 37 Kuwaiti doctors and trainees specializing in general surgery and anesthesia. These medical professionals were trained to offer assistance in crisis situations resulting from wars and natural disasters. A selected group will be dispatched to the Gaza Strip to provide medical support to the injured Palestinian population.

At the conclusion of the training courses, Mr. Isam Al-Sager, Vice Chairman and Group CEO of NBK, welcomed the medical personnel. Also present were Dr. Hilal Al-Sayer, Chairman of the Board of Directors of Kuwait Red Crescent Society (KRCS), Palestinian Ambassador to Kuwait Rami Tahboub and representatives from UK-based David Knott Foundation Medical Director Dr Ammar Darwish and representatives from British Embassy Kuwait.

Strategic Partnership

In his speech, Al-Sager extended a warm welcome to the attendees, conveying NBK’s delight in partnering with Kuwait Red Crescent Society and David Nott Foundation. This collaboration underscores the bank's commitment to its strategic partnership with KRCS, aimed at bolstering humanitarian endeavors both within and beyond Kuwait’s boarders.

He elaborated on NBK’s commitment to extending aid to the people in Gaza Strip, aiming to bolster their resilience in the wake of Israeli aggression. The bank's sponsorship of the collaboration between KRCS and David Knott Foundation underscores this commitment. The partnership entails providing training for doctors operating in conflict and disaster zones. The bank hosted these specialized training courses for five days, from April 13 to 17, accommodating doctors and trainees from Kuwaiti medical professionals, specializing in general surgery and anesthesia.

Surgical Procedures

Al-Sager announced that a group of the trained local professionals will be dispatched to Gaza Strip, offering medical assistance to the injured individuals of the Palestinian community. They will conduct vital surgical procedures and administer treatments and medications to those impacted by the continuous Israeli airstrikes on Gaza Strip.

Pride & Gratification

"We, at NBK, are deeply honored to extend our support to KRCS's initiative aimed at performing surgical procedures and delivering essential healthcare services to Gaza Strip. This project, led by specialized medical personnel from Kuwait, is projected to directly benefit approximately 20,000 individuals in Gaza. It addresses the urgent medical and therapeutic needs of the injured and affected, while also prioritizing the critical deficit in the healthcare infrastructure of Gaza Strip. Our collaboration with humanitarian organizations endeavors to prevent the imminent collapse of the healthcare system in Gaza,” Al-Sager commented.

Familiar Territory

Al-Sager highlighted that NBK’s sponsorship of the collaboration between KRCS and David Knott Foundation isn't the bank's first initiative toward aiding the people of Gaza during their ongoing crisis. He noted that the bank had previously contributed US$5 million in October 2023 to support relief efforts. Additionally, the bank donated mobile medical clinics, fully equipped with medical equipment and devices, through KRCS to support Gaza.

Al-Sager emphasized that the bank, in collaboration with KRCS, remains steadfast in its commitment to providing assistance to those in need, particularly the Palestinian population. This commitment stems from its dedication to humanitarian and social causes, aligning with Kuwait's policy of aiding nations requiring support and championing Arab and Islamic causes, notably the Palestinian cause.

He highlighted that NBK’s initiatives and backing for humanitarian and relief endeavors epitomize its commitment to social responsibility, a principle it diligently upholds not only within Kuwait but also across the Arab world.

Thanks & Appreciation

In conclusion, Al-Sager expressed heartfelt gratitude to KRCS and David Knott Foundation for their dedicated efforts. He also expressed hope that their collaboration would successfully achieve its objectives of alleviating the health impacts on Gaza. He also voiced optimism that such initiatives would help prevent the collapse of the healthcare system in Gaza Strip and mitigate the effects of the humanitarian crisis faced by our brothers and sisters in Palestine.

Leading Organization

Chairman of the Board of Directors of Kuwait Red Crescent Society, Dr. Hilal Al-Sayer, expressed gratitude for NBK’s sponsorship and hosting of the training courses organized by KRCS in collaboration with David Knott Foundation. He remarked, "This exemplifies what we have come to expect from a leading organization like NBK, in extending its generosity to execute humanitarian projects aimed at alleviating the suffering of those in need."

He highlighted that this collaboration is part of the strategic partnership between NBK and KRCS. Through this partnership, the bank extends support to numerous charitable and humanitarian initiatives both domestically and internationally.

Moreover, Al-Sayer expressed his delight in the successful accomplishment of the training courses, fulfilling their intended objective of enhancing the skills of several Kuwaiti surgeons and anesthesiologists to deliver vital medical assistance in regions impacted by conflicts and natural disasters. He highlighted that a portion of these skilled professionals will be dispatched to Gaza Strip to provide essential medical aid to the injured and wounded members of the Palestinian community.

Recipients and Project Initiatives

He indicated that the project to conduct surgical operations and provide medical treatments in Gaza Strip will directly benefit 20,000 individuals wounded by the Israeli airstrikes, with an indirect impact on all residents living in Gaza Strip. The project spans six months and entails several activities, including conducting a comprehensive field survey to accurately assess needs and identify recipients, with a focus on those most vulnerable to death or complications among the injured. Other activities involve obtaining necessary permits, coordinating with relevant authorities, supplying medical personnel and equipment, conducting essential surgeries, and providing advanced training courses for the medical team by David Knott Foundation, facilitated in collaboration with NBK. Additionally, the project includes ongoing follow-up activities, field assessment, and media records to document its progress.

Al-Sayer concluded his speech by emphasizing that KRCS stands as a national foundation committed to consistently offering humanitarian and relief aid to those in need, demonstrating unwavering dedication to supporting afflicted and affected populations.

Specialized Training

Meanwhile, Mr. Dr Ammar Darwish from David Nott Foundation expressed his satisfaction in collaborating with KRCS to provide specialized training to a cohort of Kuwaiti general surgeons and anesthesiologists. He extended gratitude to NBK for sponsoring and hosting these specialized training sessions.

Skill Development

He emphasized that David Knott Charitable Foundation remains steadfast in its commitment to supporting and enhancing the skills of medical teams delivering urgent aid to the injured and affected individuals amidst the ongoing events in Gaza. He noted that since 2015, the foundation, specializing in training doctors operating in conflict zones and areas struck by natural disasters, has consistently provided training courses to national teams across various countries. These courses aim to elevate their abilities to deliver essential medical care in regions impacted by wars and calamities.

Kuwait: NBK and LOYAC Sponsor Kids in low Income Families Through ‘Eid Clothing’ Campaign

16.04.2024National Bank of Kuwait (NBK) and LOYAC organized “Eid Clothing” campaign to support children in low income families through purchasing new Eid clothing to celebrate Eid Al-Fitr by dressing up and wearing their new outfits. The campaign covered purchasing new Eid clothing to 30 children in Kuwait.

Each dedicated volunteer was assigned to accompany a child to go shopping. The shopping trip included buying new clothes and shoes for Eid Al-Fitr, so that children would look their best and don’t feel left out of the celebration mood due to the limited resources of their families.

“NBK is so proud of its cooperation with LOYAC. We highly appreciate its role in the community through organizing a wide range of volunteering, developmental, awareness and social initiatives”,Joanne Al AbdulJaleel,NBK Public Relations Manager said.

“The “Eid Clothing” campaign, launched to support children in low income families, is considered a unique initiative across Kuwait. It extends a helping hand to families in need to bring them the joy of Eid through providing the necessary support to whomever in need, so no one is left out when celebrating Eid holidays” she added.

She highlighted that NBK is always committed to supporting humanitarian initiatives and is proud to lead this campaign with LOYAC. “We look forward to organizing this campaign to complement our community and philanthropic initiatives that share the same objectives of lending helping hands to those in need,” she noted.

Al AbdulJaleel stressed that NBK firmly believes that this social commitment is a fundamental cornerstone of NBK’s objectives as a leading financial institution, expressing his hopes that this campaign had left a positive impact on children and brought them happiness, confirming that NBK’s mission is to bring joy and hope for a better tomorrow.

The initiative is part of NBK’s commitment to its social responsibility program in Ramadan and expanding its reach to cover more sustainable programs.

NBK continues to reinforce its leading corporate citizen role committed to bringing positive values to the community through its CSR initiatives that adopt a wide range of objectives.

NBK’s participation in this initiative is part of its partnership with LOYAC through its participation in similar campaigns covering training, developmental, educational and social services programs.

Kuwait: NBK Earns Best Bank for ESG-Related Loans Award

15.04.2024National Bank of Kuwait (NBK) was named the Best Bank in the Middle East for ESG-Related Loans in 2024, as announced by Global Finance in its fourth annual Sustainable Finance Awards.

This annual survey conducted by Global Finance recognizes global and regional leadership in Sustainable Finance-funding for initiatives designed in 2023 to mitigate the negative impacts of climate change and help build a more sustainable future for humanity.

Criteria for evaluation included governance policies and goals as well as measurable achievements in environmental and social sustainability financing.

Winners have been chosen in areas such as overall sustainability financing, excellence in bond issues, community support, resource management, transparency & reporting, infrastructure, and emerging-markets sustainability funding.

In recent years, NBK Group has undertaken significant measures to embed ESG standards into the core of its business, operational procedures, and corporate culture.

The Group has also streamlined its ESG strategy, transitioning from a six-pillar approach to a more integrated framework consisting of four interconnected pillars: Governance for Resilience, Responsible Banking, Capitalizing on our Capabilities, and Investing in our Communities.

Furthermore, NBK spearheaded initiatives to capitalize on the growing trend towards sustainable financing, launching services and products geared towards the green transition process across all its locations. These include offerings such as green mortgage loans, consumer loans for electric vehicles, financing options related to sustainability, and low-emission housing loans.

Additionally, the Bank has established a target to decrease gross operational emissions by 25% by 2025 compared to the levels recorded in the reference year of 2021. Moreover, NBK’s headquarters achieved the prestigious gold certification in the Leadership in Energy and Environmental Design (LEED Gold) accreditation, underscoring its commitment to environmental sustainability and energy efficiency.

NBK's sustainability endeavors form a crucial component of its overarching strategy aimed at becoming carbon neutral by 2060 and its ambitious goal of achieving net-zero operationally by 2035.

Kuwait: NBK Organizes “Safe Ramadan” Campaign in Collaboration With Kuwait Fire Force

14.04.2024National Bank of Kuwait (NBK) in collaboration with Kuwait Fire Force organizes its Safe Campaign during the summer season.

NBK volunteers along with the Kuwait Fire Force team visited Kuwait Towers, to provide visitors with safety kits that included a fire blanket, fire alarm, first aid and fire extinguisher to support ensuring that they adhere to regulations for safety.

“The campaign targeted limiting the fire incidents during Ramadan”, said Yaqoub Al Baqer, NBK Public Relations Senior Manager. “NBK Volunteers and Fire Force team visited Kuwait towers to distribute the safety kits”.

“NBK aims to help keep the environment clean and people safe this Ramadan. The visits aimed to urge people to enhance their security as well as environmental awareness about precautions to be used to prevent accident fires and maintain cleanliness”, he added.

NBK and Kuwait Fire Force Team distributed safety kits and provided visitors with a safety kit ensuring that they adhere to regulations for safety and wellbeing.

Al Baqer praised the Fire force efforts and the influential role they play in raising to avoid accidents during camping.

Kuwait: NBK Receives Brandon Hall Group Bronze Excellence Award

14.04.2024National Bank of Kuwait (NBK) received the coveted Brandon Hall Group Bronze Medal for its excellence in the “Best Advance in Compliance Training” in the Learning and Development program, acknowledging its outstanding training and development programs.

The award was presented to Mr. Emad Al-Ablani, GM – head of Group Human Resources by the representative of IQUAD, the leading digital learning solutions provider at NBK HQ.

Brandon Hall Group employed an extensive set of criteria to select the winners of the 2023 Excellence Awards. These criteria were developed based on an assessment of the success of the compliance training in satisfying learning objectives and aligning with the business environment.

They also examined whether the program's design was rooted in a well-defined business goal and effectively supported compliance objectives. Furthermore, they ensured that compliance training positively influenced both organizational goals and learning outcomes and that the program produced quantifiable benefits and outcomes. Finally, these criteria sought to establish if the overall compliance training program positively impacted both learners and the organization.

Brandon Hall Group is a prominent global research organization headquartered in the United States. For over 21 years, the company has been dedicated to recognizing exceptional initiatives and best practices in various areas, including education, leadership development, the promotion of diversity and inclusion, and numerous other aspects related to human resources.

The Brandon Hall Awards for Excellence in Human Resources Management were initiated over two decades ago and remain a pioneering recognition program in education and development.

These awards consistently draw participation from companies spanning various industries and regions worldwide, including government entities, private businesses, joint ventures, and non-profit organizations. Their enduring prestige and widespread recognition underscore their profound importance and esteemed reputation on the global stage.

The compliance training program stands as a crucial initiative in collaboration with IQUAD, NBK’s digital learning partner, tailored to meet the training requirements of employees and facilitate their comprehension and adherence to the bank's policies and procedures, as well as relevant laws and regulations. The program's training content is engaging, interactive, and extensive, incorporating various teaching approaches such as videos, simulations, and assessments. These methods ensure a more comprehensive understanding and practical application of compliance requirements.

NBK Training and Development Department continually adapts its initiatives by recognizing the evolving requirements of the group's workforce. This includes introducing new educational opportunities to foster an open work culture and cultivating an environment that inspires employees to innovate and unleash their creativity.

NBK is consistently seeking inventive methods to streamline learning and improve its accessibility to benefit employees, all while placing a significant emphasis on the practical implementation of the acquired knowledge. Furthermore, NBK has cultivated exclusive training programs through collaborations with prestigious universities and institutions worldwide over the years. This strategic partnership ensures the delivery of exceptional, top-quality training tailored to meet the diverse needs of employees across various functional levels within the NBK Group.

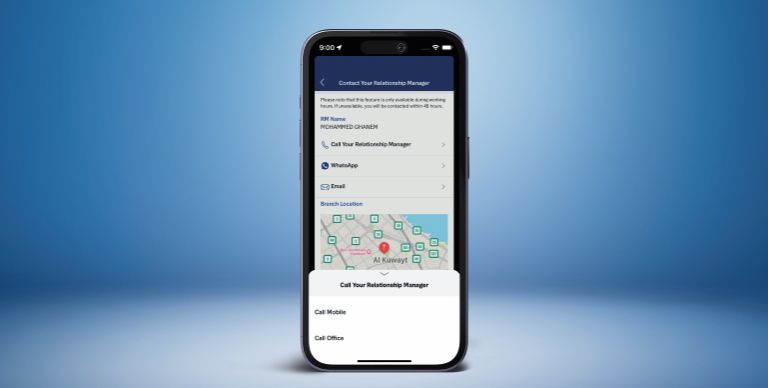

Kuwait: NBK Provides access to RMs on the Go with Contact Your RM” Feature on MoB

07.04.2024NBK always strives to elevate Privilege Banking services for a standout customer experience, the new service provides customers with seamless interaction with their Relationship Managers. This innovative service puts customers directly in touch with their Dedicated Relationship Manager, offering seamless and personalized banking experience on the go.

On this occasion, Intekhab Abbas Head -of Premium segment, Consumer Banking Group at National Bank of Kuwait said: “This new service will allow Privilege Package customers easily access their Relationship Manager’s contact information, including Relationship Manager name, phone number, and email address directly within NBK Mobile Banking App, along with ability to call, e-mail and WhatsApp them through the app as well. The NBK Mobile App will also facilitate easy appointment booking with their Relationship Manager. The feature will also allow the customer to conveniently displays their Relationship Manager’s branch location, and working hours, keeping them informed and empowered. This service can be accessed under Premium Banking section specially created in the application”.

NBK offers Privilege Banking Customers an exclusive array of services that has been strengthened to ensure a quality customer experience. These services include: a Dedicated Global Relationship Manager taking care of all their local and global banking needs, as well as a wide range of preferential services and financial products, Premium Services Lounges and Premium Concierge Service. Furthermore, Privilege Customers can avail the advantages of Family Banking Services, Global Banking, NBK Home Banking and Multicurrency cash delivery in Kuwait.

Our Premium Banking Customers also benefit from the Premium Banking Teller Services, priority in making their transactions in a quick and easy way, card home delivery service, priority status when contacting NBK Call Center on 1801801 that’s available 24/7.

In addition to "Know Your Relationship Manager" NBK has recently enhanced Privilege Banking benefits by introducing a new travel experience that redefines the travel experience for our Privilege Customers. Customers can now enjoy exclusive services such as Fast Track check-in, Extra luggage, Seasonal free Limousine ride during travel season, Exclusive Hotel Offers, Free Luggage Delivery, Discounted Umrah Packages, Visa Assistance, and discounts on luggage at Samsonite.

As NBK maintains its dedication to top-notch Privilege Banking services, we continue to innovate and provide customers with unparalleled banking experience.

Kuwait: NBK Shares Gergean Happy Moments with Children at NBK Hospital

25.03.2024On the occasion of the Holy month of Ramadan, National Bank of Kuwait (NBK) held its annual Gergean event at NBK Specialty Hospital and Stem Cell Therapy Unit, at Al Sabah Medical district, to celebrate with the children the happy moments of Gergean and present them with felicitations and gifts.

Mr. Shaikha Al Bahar, NBK Group Deputy Chief Executive Officer, along with NBK Public Relations and NBK Family shared happy moments with children.

NBK has always considered supporting the children an essential part of its social and community outreach. Sharing with these children residing at NBK Hospital major social and religious occasions come as part of an extensive social outreach program specifically mapped out and implemented by NBK.

NBK’s visit to the hospital was emotional and overwhelming for both the children and NBK Team. It is a well rooted tradition that has been carried out by NBK each year in its efforts to continuously have an active role in the Kuwaiti society.

NBK Children’s Hospital stands as a landmark for the bank's social initiatives towards children. NBK expanded the hospital’s capacity and opened recently the only Stem Cell Therapy Unit for children in Kuwait, further expanding its hospital’s ability to treat children with cancer and blood diseases. Recently, NBK donated KD 13 million to the ministry of health to build a new full equipped medical building to increase the hospital’s capacity.

Helping and supporting children and their families are integral parts of the Bank's culture and practices that reflect its deep commitment to its corporate social responsibility.

Since its establishment, NBK has been at the forefront of supporting Kuwait’s community through a range of education, health, sports and social initiatives. The establishment of NBK Children Hospital at Al Sabah Medical Area stands as one of many NBK initiatives for children.

NBK has undertaken several initiatives to support the healthcare sector in Kuwait, including the establishment of NBK’s Children’s Hospital at Al Sabah Medical Area, which provides medical care to underprivileged children. The hospital houses a number of clinics specialized in leukemia treatments, neurology, psychiatry and pediatrics as well as surgeries and operating theatres.

In line with NBK Children Hospital’s strategy to provide integrated care for patients, the hospital’s management embeds the wellbeing of children and their families as a key part of the treatment programs and healthcare services. To this end, the hospital organizes many various activities to ensure continuous communication with patients and their families, as well as to raise patients’ satisfaction and encourage them to socialize and distract from the pains of treatment.

On Mondays of every week all year round, the hospital holds a fun activity for children treated at NBK’s Specialized Hospital for Children, including inpatients and outpatients visiting the hospital for the necessary medical examinations to follow up on their health conditions.

NBK has also provided an indoor cinema for inpatient children to watch their favorite movies with their siblings.

NBK also organizes ‘I Dream to Be’ program, which is the first of its kind for children in Kuwait hospitals who are facing life-threatening conditions. The initiative helps the children realize their ‘dreams’ in an effort to improve their emotional and psychological wellbeing and help them fight the diseases. Through this program NBK helped many patients realize their dreams over the past years.

The hospital also provides a number of integrated social programs for children and their families as well as the medical staff to ensure an integrated benefit for all. This includes including organizing weekly entertainment activities and the selection of “champion of the week”, in addition to choosing “the nurse of the month”. The hospital also organizes regular activities including “reading corner”, library, reading sessions, visits and entertainment activities. This comes within the endeavors to support and care not only for children during their treatment journey, but also for the attending medical staff.

Kuwait: NBK Distributes Thousands of Iftar Meals at Different Areas in Kuwait

24.03.2024As part of fulfilling its ongoing corporate social responsibilities and on the occasion of the Holy Month of Ramadan, National Bank of Kuwait (NBK)’s Public Relations Team distributed thousands of meals and special convoys to fasters daily at many Areas in Kuwait. This initiative comes within the framework of the ongoing "Do Good Deeds in Ramadan" philanthropic campaign launched by the bank.

Also, NBK distributed dates and water at different intersections and bus stops in Kuwait before iftar time as part of “Do Good Deeds in Ramadan”. The campaign aimed to raise awareness at reducing accidents, speeding and committing traffic violations during the holy month of Ramadan, especially during the run up to iftar at different areas.

The initiative involved a large number of NBK volunteers who distributed small snacks for drivers to break their fasting around Iftar time, at strategic intersections and traffic lights, as well as bus stops.

“NBK Iftar banquets, an annual NBK philanthropic tradition and a landmark activity within the bank’s corporate social responsibility, acquired much more momentum this year distributing daily thousands of Iftar banquets at many Areas in Kuwait, including Farwaniya, Salmiya, Bneid Al Qar and Jleeb, in addition to hospitals: Amiri, Mubarak and Sabah as well as Kuwait Airport terminals 1 and 2”, said Talal Al Turki, NBK Public Relations Senior Manager.

"The distribution scale and range of NBK Iftar banquets this year also included distributing fast-breaking meals via special convoys to various crowded locations in Kuwait. A large number of NBK staff volunteers was ready to serve the fasters", Al Turki added.

Commenting on dates and water distribution, “NBK is proud to launch this initiative, which combines giving and sharing spirit in offering snacks to drivers to break their fasting and raising safety awareness to reduce traffic accidents, especially around Iftar time”. He stated.

“NBK is committed to adopting value-added social initiatives, especially those related to the holy month of Ramadan,” he added.

For almost three decades, the Ramadan program comprised a series of activities and initiatives aimed at encouraging community engagement and solidarity in Kuwait. “NBK hopes to encourage a greater sense of responsibility during the holy month”, Al Turki noted.

It is worth mentioning that NBK’s NBK Iftar banquet campaign launched with the commencement of the Holy Month of Ramadan as part of an extensive social program comprising a multitude of philanthropic activities.

Kuwait: NBK’s AGM Approves All Motions Proposed by the Board of Directors

24.03.2024National Bank of Kuwait (NBK) held its Annual General Meeting (AGM) for 2023 on Saturday, March 23, 2024, with a quorum of 71.87%. The AGM approved the Board of Directors’ recommendation to distribute 25% cash dividend to shareholders (25 fils per share) for the second half of the financial year, bringing the total cash dividend distributions for the year to 35%, in addition to the distribution of 5% bonus shares (5 shares for every 100 shares owned).

Consistent Progress

In his speech to the AGM attendees, Mr. Hamad Al-Bahar, NBK Group Chairman, emphasized that the strong financial results achieved by the bank in 2023 highlight its unique business model and strong financial position. This performance reaffirms NBK’s dedication to providing the highest returns for shareholders and promoting sustainable growth.

Al-Bahar highlighted the multitude of successes attained by the bank in 2023, further solidifying its track record of accomplishments and leadership both domestically and internationally. These endeavors were acknowledged with numerous prestigious awards, further affirming NBK’s position of excellence.

"Our sustained achievements stem from our core strategy of diversification, which lies at the foundation of our operations. By strategically expanding our portfolio and services across various geographical locations, we mitigate risks, capitalize on potential opportunities, and reinforce our dedication to adaptability, resilience, and long-term stability."

"We remain committed to making substantial strides in executing our strategic agenda, and we are optimistic that our accomplishments over the past year will serve as a catalyst for enhanced performance in the future." Al-Bahar emphasized. He also underscored NBK's robust balance sheet and stable capital foundation, highlighting their role in meeting the evolving demands of customers and delivering optimal returns for shareholders.

Al-Bahar further stated, "Our endeavors yielded improvements across all key performance indicators compared to the previous year. This underscores the effectiveness and adaptability of our long-standing strategy, solidifying our position as a safe haven for investors, depositors, wealth management clients, individuals, and businesses alike. Moreover, we remain committed to leveraging the potential of digital transformation and sustainability initiatives, while fostering collaboration with communities, corporations, and individuals to foster a brighter and more inclusive future."

Social Responsibility

Al-Bahar highlighted the bank's prominent role in social responsibility over the past year, establishing itself as a leader in Kuwait. The bank contributed over KD 28 million across various sectors including healthcare, childcare, societal initiatives, environmental causes, sports, and education.

Expanding our Footprint

Discussing the bank's prospects for the current year, Al-Bahar remarked, "Regarding our outlook for 2024, our expansion efforts will primarily focus on Kuwait as our core market, with strategic initiatives in the GCC markets. We intend to further strengthen our presence in current markets through strategic investments. Additionally, the bank aims to introduce its proven digital banking solutions in other markets, while enhancing its footprint across MENA region."

Unwavering commitment

Al-Bahar emphasized NBK's unwavering dedication to upholding the highest ethical standards and governance principles. He highlighted the bank's dynamic and proactive governance framework, which fosters transparency, accountability, and ethical conduct across all levels. Al-Bahar noted that the Board of Directors, in collaboration with the dedicated executive management team, prioritizes aligning strategic decisions with the bank's core values to effectively serve the interests of its shareholders.

Historical Earnings

Meanwhile, Mr. Isam J. Al-Sager, NBK Group Vice Chairman and CEO, outlined in his speech that the bank reached its highest annual profit on record in 2023 and maintained strong profit trends. This accomplishment was supported by its diversified business model, strategic investments, and resilience in the face of various economic conditions.

Al-Sager highlighted that despite the challenging operating environment and geopolitical tensions experienced last year, the bank achieved a record profit of KD 560.6 million, marking a year-on-year growth of 10.1%. Additionally, the operating profit surged to KD 1.2 billion, reflecting a substantial increase of 15.6%.

Al-Sager further stated, "Our core segments exhibited strong performance and sustained operational momentum, particularly in our international operations and wealth management divisions. Additionally, Boubyan Bank further supported our competitive edge in the local market as the sole banking group offering both Islamic and conventional banking services in Kuwait."

He explained that the bank maintained consistent dividend rates of 35 fils per share by the end of the year, highlighting the strong financial position of the Group and its commitment to providing shareholders with optimal returns.

He highlighted that as of December 31, 2023, total assets stood at KD 37.7 billion, marking a 3.7% year-on-year increase. He attributed this growth primarily to the expanding volume of the Group's business across diverse sectors and activities.

Al-Sager also indicated that shareholders' equity reached KD 3.7 billion, reflecting a notable annual growth of about 7.3%. Return on average shareholders' equity stood at 15.0%, while return on average assets demonstrated strong rates, reaching 1.53% in 2023. Moreover, customer deposits surged to KD 21.9 billion by year end, marking an 8.8% increase compared to 2022. Concurrently, loans and advances experienced a growth of 6.1%, reaching KD 22.3 billion. Additionally, the capital adequacy ratio surpassed the minimum required levels, reaching 17.3%.

Challenges and Opportunities

Al-Sager remarked that Kuwait encountered challenges akin to those experienced globally in 2023. However, he highlighted several opportunities seized upon during the past year. These included the sustained increase in oil prices, the flexibility observed in consumer spending, accelerated growth in the projects market compared to previous years, positive trends in employment and population growth, advancements in the refining sector, and a less hawkish monetary policy approach. These factors collectively contributed to shaping a favorable economic environment in Kuwait.

He highlighted that the remarkable achievements of the bank in the previous year were attributable to several factors, including leveraging its geographical footprint, advancing the digital transformation initiative, and maintaining a robust financial position. These aspects strengthened revenue streams while maintaining the bank's prudent policies over the years. Consequently, this positively impacted asset quality and boosted capitalization.

Centre of Attention

Al-Sager emphasized that in 2023, NBK continued its commitment to prioritizing customers by offering innovative digital services and products to support their financial objectives.

Wealth Management

Al-Sager highlighted that in the previous year, NBK Wealth was introduced as a premier destination for pioneering and sophisticated wealth management solutions. It offers an extensive array of comprehensive services in private banking and advanced asset management through a global network spanning 9 cities across 5 countries.

In the domain of digital transformation, Al-Sager emphasized that the bank leads among financial institutions in digital innovation, prioritizing a banking experience tailored to the actual needs and aspirations of its customers. He noted that the bank's unwavering dedication to addressing customer needs has played a pivotal role in reshaping the lifestyles of its customers through a meticulously crafted range of digital services and products.

Sustainability Momentum

Al-Sager elaborated that the bank sustained its progress in sustainability by embarking on a new trajectory for its environmental, social, and corporate governance (ESG) strategy. This involved the adoption of a formal ESG governance framework and the integration of these standards across its services and products. For instance, it introduced green mortgage loans, consumer loans for electric vehicles, financing options related to sustainability, and low-emission housing loans.

“Recently, we have been recognized as the Best Bank in the Middle East for ESG-related loans. Furthermore, we have successfully finalized and approved the ESG framework, clearly defining responsibilities among members of the executive management. We have also established the Sustainability and Climate Change Committee, which operates under the direct oversight of the Board of Directors.

Al-Sager highlighted that NBK has maintained a high score by CDP, distinguishing itself as the sole bank in Kuwait to receive this recognition. Furthermore, NBK ranks among the highest-rated GCC financial institutions engaged in this initiative. Additionally, the bank has committed to reducing total operating emissions by 25% by 2025 and aims to achieve zero emissions operationally by 2035. These initiatives are integral to the bank's overarching plans to attain carbon neutrality by 2060. Consequently, these efforts led to an upgrade in the Bank's MSCI ESG Governance rating to BBB as per the 2023 review.

A Sustainable Future

"Our agile strategy and resilient business model will persist in steering us towards delivering utmost value to our stakeholders, serving as a cornerstone in our journey towards a digital and sustainable future. We remain steadfast in our commitment to sustaining revenue growth through responsible banking practices, strategic investment in our future, innovative products and services, enhancement of our digital capabilities, fostering holistic community development, and playing a significant role in fostering economic growth in Kuwait and beyond." Al-Sager said.

Focus on profitability

"As we navigate the opportunities and challenges of 2024, our dedication to prioritizing profitability, capital resilience, and sustainable growth remains unwavering. However, we recognize the need to closely monitor several challenges, with geopolitical tensions in the region standing out as particularly significant." Al-Sager concluded.

Diverse Mix

On the sidelines of the AGM, Ms. Shaikha K. Al-Bahar, NBK Deputy Group CEO highlighted that NBK has witnessed positive growth trends in the previous year, demonstrating continued success in executing its strategic plans, confirming that the primary sources of profitability in 2023 were centered around core banking operations.

Al-Bahar explained that NBK's performance in 2023 showcased the effectiveness of its diverse business portfolio and prudent risk management practices. She highlighted the substantial strides made in executing its customer-centric strategy, underscoring NBK's sustained momentum across various fronts. This encompassed achieving robust levels of capitalization, maintaining high credit quality, and strengthening customer relationships, all of which led to an expansion in business volume.

She emphasized that these factors were pivotal in driving last year’s strong performance and will play a significant role in generating sustainable value for shareholders in the long term. She also highlighted the bank's ongoing commitment to expanding its business operations while enhancing the quality of its services.

"2023 served as a testament to the resilience of our investment philosophy in driving growth initiatives and the importance of customer-centricity. These factors propelled the ongoing expansion across our diverse business sectors. Throughout the year, we remained committed to investing in the future, enhancing our digital capabilities to improve customer service, and introducing innovative products and solutions aimed at facilitating our customers' banking needs." Al-Bahar said.

Al-Bahar emphasized that the International Banking Group (IBG) maintained robust performance and supported the balance sheet, accounting for 24% of operating income and 23% of the Group's profits. This underscores their significant contribution to the overall performance of the Group.

She highlighted that in 2024, IBG will strengthen the bank's footprint in key regional markets, particularly in Saudi Arabia and the UAE. This will involve targeting Government Related Entities and Top-Tier Corporations. Additionally, strategic expansion efforts will focus on the European Union, particularly in corporate lending, trade finance, Commercial Real Estate, and residential mortgages. The Group also aims to strengthen its footprint in Asia through its regional hub in Singapore while diversifying its Commercial Real Estate portfolio.

Al-Bahar further emphasized that IBG are committed to diversifying the Group's commercial real estate portfolio. Additionally, they aim to integrate ESG standards into credit management processes while promoting digital and technological investments across the business network.

She emphasized that throughout 2023, the bank remained focused on maintaining high asset quality and strong capitalization. Highlighting the significance of the Saudi market, she noted that it is a key priority for the NBK Group due to the numerous emerging opportunities aligning with the bank's strategic goals. Additionally, she highlighted the profitability of the bank's operations in Egypt, which continue to be among the most lucrative within the Group, boasting the highest returns on both shareholders' equity and assets.

Wealth Management

Al-Bahar highlighted that NBK Wealth Group played a significant role in 2023, contributing 10% to operating income and approximately 11% to the Group's profits. She noted that the previous year marked the official announcement of the launch of its brand, solidifying its position as one of the largest regional groups in comprehensive wealth management. The group caters to high-net-worth individuals and corporations, offering tailored financial advisory services aimed at protecting and growing the wealth of its customers, through offering innovative and comprehensive banking and investment solutions.

She further mentioned that NBK Wealth, with approximately US$37.6 billion in personal financial assets by the end of 2023, boasts an elite team comprising over 100 investment experts and brokers with extensive experience in the field.

Revolutionary Change

Al-Bahar emphasized that the bank has made significant progress in its digital transformation journey by introducing notable updates and enhancements to the NBK Mobile Banking App. These updates represent a revolutionary shift in how customers engage with their everyday banking requirements through a highly efficient and user-friendly interface. This contributes to enhancing and refining the overall customer experience.

The Best Experience

Al-Bahar highlighted that NBK's efforts persist in delivering top-tier banking experiences, operating with the utmost efficiency, and securing a significant market share by offering customers a broader array of options and numerous value-added services. She underscored the bank's consistent commitment to delivering added value for all stakeholders, employing a balanced approach to boost revenues from diverse sources, and enhancing the Group's profitability. This entails maintaining the bank's prominent position in its core business while fostering growth through expansion into sectors beyond its key business activities.

Digital Offerings

She emphasized that NBK remains dedicated to investing in its digital offerings to furnish customers with a unique and unparalleled banking experience. This commitment encompasses the implementation of cutting-edge financial tools and unique banking services, along with regular updates to the NBK Mobile Banking App, acclaimed as one of the premier banking applications in the sector. Moreover, NBK leverages data analysis and artificial intelligence across many of its services, employing machine learning techniques to deliver a personalized experience that surpasses customer expectations.

Social Initiatives

Al-Bahar confirmed that the bank's social initiatives persisted throughout the past year, marked notably by the official introduction of the "Bankee" program. This initiative aims to enhance financial inclusion, particularly among school students, fostering sustainable improvement in financial literacy levels within society. In collaboration with the Ministry of Education and Kuwait Authority for Anti-Corruption "Nazaha,", the program engaged 150 schools and over 16,000 students, supported by the participation of 3,000 teachers. Additionally, the program also included a special needs school for learning difficulties.

She highlighted that the bank's endeavors to support and empower women saw significant recognition with the NBK Rise program receiving the prestigious Best Initiative for Women in Business accolade at the MEED MENA Banking Excellence 2023. This notable achievement reflects the culmination of the bank's dedicated steps towards women's empowerment. Importantly, this effort extends beyond the bank itself to encompass several leading organizations in Kuwait.

Leadership Centre

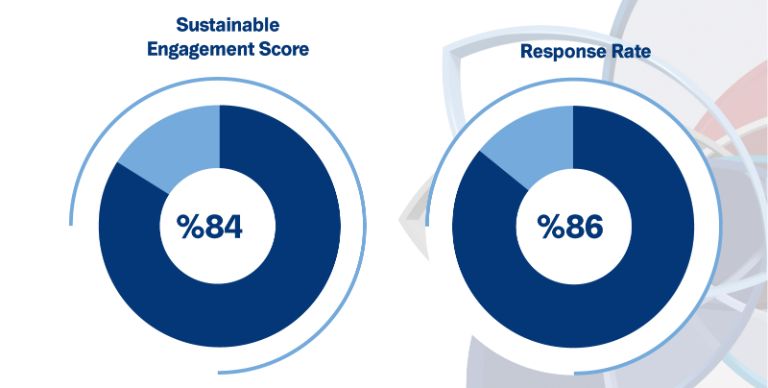

On the sidelines of the AGM, Mr. Salah Y. Al-Fulaij, Chief Executive Officer – Kuwait remarked that throughout 2023, NBK’s endeavors were marked by initiatives aimed at strengthening its leading position in Kuwait and enhancing customer loyalty.

Al-Fulaij further added that the bank focused on enhancing and refining the NBK Mobile Banking App by incorporating over 30 enhancements to improve both user interface and experience. He highlighted that the App witnessed over 50 million banking transactions in the past year, marking a notable 19% year-on-year growth.

He emphasized that NBK Mobile Banking App is elevating digital offerings to new levels as part of the bank's ongoing endeavors to empower customers through the digital transformation journey. This is particularly evident in the substantial increase in customer satisfaction rates, exceeding 90%, following the recent update of the new App.

The Youth Segment

Al-Fulaij indicated that in 2023, the bank continued to leverage the valuable offerings provided by Weyay Bank, increasing its market share in the youth segment to over 30%. Additionally, the bank forged a partnership with MasterCard, which now serves as the exclusive provider of bank cards.

He highlighted that NBK extended bank cards to SMEs as part of its commitment to catering to the needs and demands of this segment. Moreover, the bank entered into several partnerships to introduce new services, including exclusive offers for retirees in collaboration with the Public Institution for Social Security.

He emphasized that the bank has broadened its range of robust offerings for customers in the premium services sector through partnerships with top-tier brands, providing this segment with an exclusive lifestyle experience.

“We will persist in implementing customer-centric strategies that foster technological advancements and introduce innovative initiatives to bolster NBK's standing as a reliable financial partner and establish new benchmarks in Kuwait's banking industry,” Al-Fulaij said.

Al-Fulaij underscored that NBK's commitment to delivering exceptional products and services to its customers earned it several accolades throughout the year, notably being recognized as the Best Innovation and Transformation (World) by Global Finance. He emphasized that NBK's significant and strategic investments in its workforce, operational infrastructure, and digital platforms over the years have unequivocally proven their worth and effectiveness.

Maximum Benefit

Al-Fulaij emphasized that NBK's Personal Banking Group capitalized on the momentum of consumer spending and operations by offering exceptional banking services and products. He highlighted the implementation of a strategy that prioritizes customer choice based on individual needs and lifestyle preferences when designing products. Additionally, he emphasized NBK's commitment to maintaining a significant digital advantage over its competitors.

He added that the Corporate Banking Group remains steadfast in achieving its strategic objectives, with a primary focus on maintaining and expanding NBK's leadership and market share as the preferred corporate partner in Kuwait.

He emphasized that the bank plans to continue leveraging new business opportunities with existing customers and attract new ones, thanks to its exceptional service and the strength of its capital base.

Al-Fulaij elaborated that in 2023, the Corporate Banking Group introduced a pioneering set of commercial cards, the first-of-its-kind in Kuwait, aimed at empowering customers to manage their business expenses effectively. Additionally, new services were introduced to streamline the provision of digital and physical documents to corporate clients, fostering the growth of our medium-sized corporate clientele.

“In 2024, our focus will remain on maintaining prudent credit risk management practices, We will continuously monitor and assess the performance and effectiveness of our interactions with corporate customers, to continually enhance our offerings. Moreover, we are committed to continue our efforts to integrate ESG standards into our assessments of corporate customer credit and creditworthiness, thereby fostering improved governance in business practices,” Al-Fulaij commented.

Renewed Momentum

Al-Fulaij also noted that Kuwait's operating environment in the past year displayed continued signs of recovery, driven by increased consumer spending and improved business activity. Additionally, there was a gradual recovery in spending and project awards, with project activities experiencing their strongest performance since 2017 in terms of the value of contracts awarded. This positive trend is expected to have a favorable impact on private sector lending.

Key Pillar