Al Jawhara Account

More Millionaires

With Al Jawhara Account

Open Al Jawhara Account today and enter the draw to win Kuwait’s biggest prizes total to KD 5,000,000.

What Do I Get?

Get exceptional benefits and opportunities to enter and win the draws

Account Opening

Account Opening

You can open your account in KD only via NBK Mobile Banking App or NBK Online Banking or visit the nearest NBK branch.

Grand Prize

Grand Prize

Get the chance to be a millionaire with KD 1,000,000 as the grand prize draw three times a year.

Double Chances

Double Chances

Double your winning chances by not making any withdrawals, debit transactions during the holding period of each draw. You’re still eligible if you are an Al Jawhara Account holder for 2 years or more.

Automatic Enrollment

Automatic Enrollment

You automatically get enrolled in Al Jawhara weekly, monthly and grand draws three times a year.

Discover The New Additions in

Al Jawhara Account

Seize the moment and open Al Jawhara Account today.

Al Jawhara Saver Account

Apply to the first of its kind account and get competitive rates and earn bonus interest.

Apply Now and Get

- Competitive rates on your savings

- Earn bonus interest for the first year

- Enter Al Jawhara monthly and grand prize draws

The more you save, the higher interest you can earn:

| Tier | Rate | Bonus Interest | |

|---|---|---|---|

| KD 500 - 4,999 | 0.125% | 0.250% | |

| KD 5,000 - 9,999 | 0.370% | 0.500% | |

| KD 10,000 and above | 0.750% | 1.500% | |

Benefits of Al Jawhara Accounts

Benefits of Al Jawhara Accounts

| Comparison | Al Jawhara Account | Al Jawhara Junior Draw | Al Jawhara Saver Account |

|---|---|---|---|

| Interest Bearing | Not applicable | Not applicable | Applicable, with a minimum balance of KD 500 |

| Bonus Interest | Not applicable | Not applicable | Applicable for the first year |

| Weekly Draws | Eligible | Eligible | Not eligible |

| Monthly Draws | Eligible, with a minimum balance of KD 1,000 | Eligible, with a minimum balance of KD 50 | Eligible, with a minimum balance of KD 5,000 |

| Grand Prize Draws | Eligible, with a minimum balance of KD 1,000 | Eligible, with a minimum balance of KD 50 | Eligible, with a minimum balance of KD 5,000 |

| Al Jawhara Junior Draws Entry | Eligible | Eligible | Not eligible |

| Opening Balance | KD 400 | Not applicable | KD 500 |

| Minimum Balance Fee | KD 2 if monthly average balance drops below KD 200 | Not applicable | Not applicable |

| Double Chances | Eligible | Eligible | Eligible |

| Loyalty Chances | Eligible | Eligible | Eligible |

TELL ME MORE

Calculate

Your Chances of Winning

Use the Al Jawhara Calculator to find out your winning chances.

Calculate

There's More For You

With Al Jawhara Account

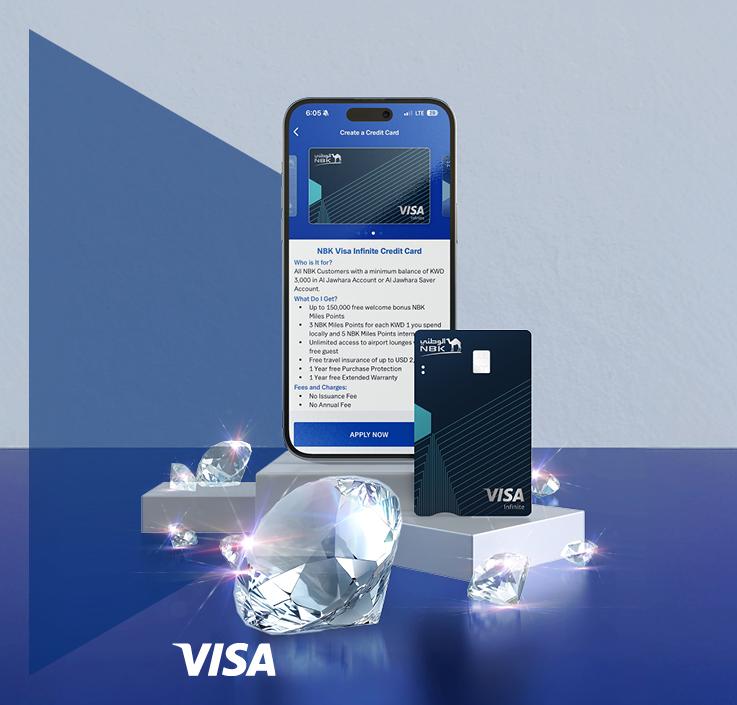

Not an Al Jawhara or Al Jawhara Saver Account customer? Open the account today and apply for NBK Visa Infinite Credit Card free for life against blocking a minimum of KD 3,000 to enjoy up to 150,000 NBK Miles Points, 3x the amount, in addition to 3x the chances in Al Jawhara draws.

Terms and conditions apply*

Apply NowFees and Charges

KD 50

Equals one chance in the draw

Minimum balance charge

KD 2

If your account’s monthly average balance falls below KD 200

KD 400

Minimum account opening balance

FAQs

- Al Jawhara Account can be opened by all customers including minors with their legal guardian.

- Al Jawhara Saver account can be opened only for customers aged 21 and above.

- All Al Jawhara Accountholders below the age of 21 will be automatically enrolled in Al Jawhara Junior Draw, in addition to entering Al Jawhara weekly KD 20,000, monthly KD 125,000 draws and grand prize draw of KD 1,000,000.

The weekly draw is for KD 20,000, the monthly draw is for KD 125,000 and the grand prize draw three times a year is KD 1,000,000.

For the monthly draw, 3 winners will receive KD 1,000 each, and 4 winners will receive KD 500 each. For the grand prize draw held three times a year, 1 winner will receive KD 10,000.

Each KD 50 equals one chance in the draw.

In case of no withdrawals or transfers from your Al Jawhara Account during the required holding period for each draw, you will get 1 extra chance for each KD 50 kept in the account during that period (a week before the weekly draw, a month before the monthly draw and three months before the grand prize draw).

In addition, if you are Al Jawhara Accountholder for 2 or more years and not eligible for double chances, you will be rewarded with double chances!

In case of any withdrawals within the holding period, you will still get the regular number of chances i.e. 1 chance per KD 50.

Eligibility for the weekly draw is based on your end-of-day balance of the last deposit date, which is the week preceding the week of the draw. For example, if the draw is being held on Tuesday, 20 February, the balance calculated is your end-of-day balance as of Saturday, 17 February. In case there are no withdrawals or transfers during the holding period from Sunday, 11 February to Saturday, 17 February, you will get 1 extra chance for each KD 50 in the account. If the account is closed when the draw takes place, you will not be eligible for the draw.

Eligibility for the monthly draw is based on a minimum end-of-day balance of KD 1000 as of the last day of the month preceding the draw. For example, if the draw is being held on Tuesday, 13 February, the balance calculated is your end-of-day balance as of Wednesday, 31 January. In case there are no withdrawals or transfers during the one month holding period of Monday, 1 January to Wednesday, 31 January, you will get 1 extra chance for each KD 50 in the account. If the account is closed when the draw takes place, you will not be eligible for the draw.

Eligibility for the monthly draw is based on a minimum end-of-day balance of KD 50 as of the last day of the month preceding the draw. For example, if the draw is being held on Tuesday, 13 February, the balance calculated is your end-of-day balance as of Wednesday, 31 January. In case there are no withdrawals or transfers during the one month holding period of Monday, 1 January to Wednesday, 31 January, you will get 1 extra chance for each KD 50 in the account. If the account is closed when the draw takes place, you will not be eligible for the draw.

Eligibility for the grand prize draw is based on a minimum balance of KD 1,000 in your account for a full three-months period prior to the month of the draw. For example, for April’s Al Jawhara grand prize draw, your lowest balance during January, February and March will be used to calculate the number of chances you have in the draw. If the account is closed when the draw takes place, you will not be eligible for the draw.

Eligibility for the grand prize draw is based on a minimum end-of-day balance of KD 50 as of the last day of the month preceding the draw. For example, if the draw is being held on Tuesday, 9 April, the balance calculated is your end-of-day balance of Sunday, 31 March. In case there are no withdrawals or transfers during the three-month holding period from Monday, 1 January to Sunday, 31 March, you will get 1 extra chance for each KD 50 in the account. If the account is closed when the draw takes place, you will not be eligible for the draw.

If the average monthly balance falls below KD 200 during any given month, a KD 2 charge will be applied.

Visit Al Jawhara Winners page to find out.

The maximum balance allowed per customer in all Al Jawhara Accounts is KD 500,000. The system will not allow any deposits more than the maximum amount into your Al Jawhara Account. The maximum allowed limit for each customer to enter the draw for Al Jawhara prizes is KD 500,000 for all Al Jawhara accounts of the customer and will be determined based on the first account opening date of any the customer’s accounts.

Al Jawhara draws are all monitored by Ministry of Commerce and Industry, and conducted electronically in the presence of a representative from the Ministry. The bank provides the Ministry with the winner’s details after each draw. The bank also is collaborating with an external audit to review the draw as required by Ministry of Commerce and Industry.

Al Jawhara draws are conducted every Tuesday of every week. In case of a public holiday, the draw is then postponed to the next working day or when the bank deems appropriate. In case the bank has external events, the draw is then postponed to the event date. All changes in draw dates are communicated and approved by MOC. The draws take place at the bank’s premises or in case of an external event, the bank announces the location and time to customers in advance.

You can know your chances of winning the next Al Jawhara draw by simply logging in to NBK Mobile Banking or NBK Online Banking and using Al Jawhara Calculator to check your exact chances based on your account balance.

Once you win, you will be contacted by the bank immediately to inform you. Once the winner signs the required documents by the Bank, the prize will be credited to the account directly.

As Al Jawhara Saver Accountholder, if your end-of-day balance on the draw’s last deposit date for the monthly and grand prize draws was above KD 5,000 you will be eligible to enter those draws.

Al Jawhara Saver Account can be easily opened through NBK Branches and NBK Online Banking.

Interest is calculated daily and credited monthly. No interest will be earned for the month if more than one withdrawal is made.

Al Jawhara Saver Account is only available in Kuwaiti Dinars (KD).

The minimum balance you should maintain to be eligible to earn interest is KD 500.

If you make more than one withdrawal in a one-month period, you will lose the interest earned for that month.

If there is no activity on your account for 1 year, the account will go into dormant status, and if there is no activity on the account for 5 years or more, the account will go to unclaimed status. However, in both cases, you will enter the monthly and grand prize draws if eligible. You can reactivate your dormant or unclaimed account through NBK Mobile Banking App, or by visiting any branch. A fee of KD 5 will be charged for all reactivations in branches.

Al Jawhara Account Terms and Conditions >

Al Jawhara Saver Account Terms and Conditions >

*Al Jawhara Miles Card Terms and Conditions:

- Up to 150,000 NBK Miles Points which is 3x the NBK Miles Points amount based on the credit limit

- Card has to be issued against blocking a minimum of KD 3,000 in Al Jawhara or Al Jawhara Saver Account

- If the card is cancelled within 12 months from the issuance date, the NBK Miles Points earned will be deducted from customer’s NBK Miles Program

- Card will be free for life if the blocked amount is still valid

- Customer must not have a current active credit or prepaid card upon applying for Al Jawhara Miles Card

I'm Interested

NBK customers can apply via NBK Mobile or Online Banking, non-NBK customers simply apply below.

Thank YouFor Your Interest

An NBK agent will contact you within 2 working days.

Find Us

Find Us 1801801

1801801