NBK Invest

NBK Invest

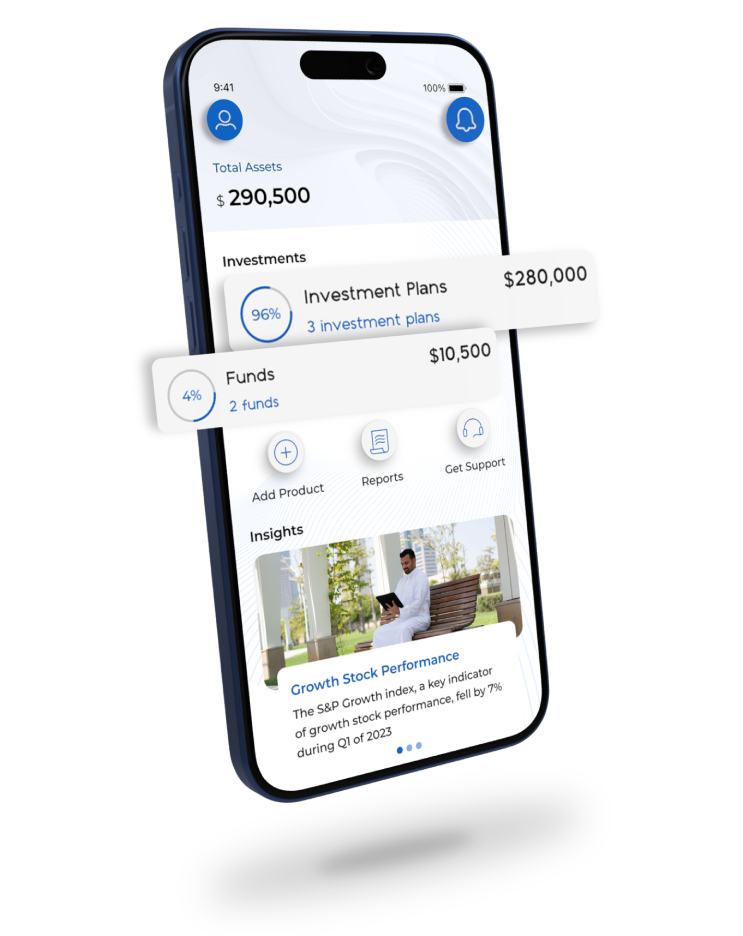

NBK Invest offers a variety of investment opportunities, making it easier to manage your investments, monitor your performance, and access valuable insights, all within one app designed to enhance your financial journey.

Features

Diverse Investment Options

Discover a range of investment products and services to suit your preferences.

User-friendly Process

Experience a seamless investment journey, whether you are a seasoned investor or are just starting out.

Expert Financial Insights

Access insights and broaden your investment knowledge.

Manage all your investments

Digitally activate, monitor, and manage your investments right from the app.

Explore our Investment Options

-

Guided Investments

Access a range of global diversified investment plans built by our expert financial advisors.

-

Money Market Funds

Low-risk investments in short-term, highly liquid, and high-quality instruments.

-

Equity Funds

Actively managed liquid funds providing exposure to equities in both local and GCC capital markets.

-

Bond Funds

Actively managed liquid funds providing exposure to fixed-income instruments in both local and GCC capital markets.

How to Get Started

Download

the NBK Invest app

Select

an investment product

Sign up and start

your investment journey

Download the

NBK Invest App

and Start Building

Your Future Today

Contact Us

NBK Headquarters, Level 35, Jaber Al-Mubarak and AlShuhada Street, Block 7, Plot 6, Sharq, Kuwait

P.O. Box: 4950 Safat, 13050 Kuwait

Email: support@invest.nbk.com

Disclaimer:

NBK Invest is a brand registered under the name of Watani Investment Company K.S.C.C. and provides prospective clients with digital access to the investment products, services, and solutions offered by Watani Investment Company K.S.C.C.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and this service's charges and expenses. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature.

Read the Full Disclosure

Find Us

Find Us 1801801

1801801