Privilege

Your World is Limitless

With Privilege

Reap the benefits of your loyalty and make the best of everything a bank has to offer, with a wide range of preferential services and financial products.

The 5 Pillars of Privilege

Exclusivity

Exclusivity

Discover unmatched exclusivity with dedicated support, priority access, premium services lounges, Premium Concierge Service, preferential rates and personalized assistance.

Investment

Investment

Discover investment products such as Islamic KD Ijara Fund V, Watani KD Money Market Fund, mutual funds, NBK Invest, Watani Brokerage and GCC bonds.

Advantages

Advantages

Discover the advantages of Privilege with Family Banking Services, Global banking, Premium Concierge Service, NBK Home Banking, and Multicurrency cash delivery.

Additional Benefits

-

Premium Services Lounges

Enjoy the comfort of premium services lounges at NBK Branches.

-

Free For Life Cards

Spend KD 10,000 or more using your NBK KWT Visa Infinite Credit Card, or KD 15,000 or more using your NBK Visa Infinite Credit Card and get your KD 100 annual fee waived.

-

Preferential Rates

Enjoy special interest rates on term deposits based on your profile.

-

NBK Branches Priority Access

Get priority access to your debit card delivery and while queuing at all NBK Branches. You can also get fast track access to the dedicated premium services team when contacting NBK Call Center

Dedicated Global

Relationship Manager

Maximize your banking experience with international NBK Branches in the UK, UAE, and Egypt.

Benefit from personalized guidance, priority assistance and leverage our extensive global network for seamless international financial solutions such as having your global Relationship Manager when traveling.

Access to Investment Products and Services

Investment

Advisory Services

NBK offers expert guidance, diverse investment options and risk profiling so you can invest with confidence.

-

Guided Investments

Access a range of global diversified investment plans built by our expert financial advisors.

-

NBK Brokerage Services

Trade in regional and US stock market with comprehensive brokerage services and expert trading support.

-

Leasing and Finance Program

This program invests in a diverse portfolio of leasing and specialty finance transactions.

-

Money Market Funds

Low-risk investments in short-term, highly liquid, and high-quality instruments.

-

Equity Funds

Actively managed liquid funds providing exposure to equities in both local and GCC capital markets.

-

Bond Funds

Actively managed liquid funds providing exposure to fixed-income instruments in both local and GCC capital markets.

Personalized Offers

Tailored to Your Lifestyle

Discover bespoke offers, tailor-made to match your unique preferences and interests.

Enjoy 10% discount on all Samsonite products when purchasing in-store.

Terms and conditions apply

Get 10% cashback in NBK KWT Points when using your NBK KWT Visa Infinite Credit Card at Zain.

Terms and conditions apply.

Enjoy 10% discount on all Samsonite products when purchasing in-store.

Terms and conditions apply

Get 10% cashback in NBK KWT Points when using your NBK KWT Visa Infinite Credit Card at Zain.

Terms and conditions apply.

Travel Benefits

-

Fast-track Check-in

Skip the queues and check in faster with the help of NAS at Kuwait International Airport. To request the service, kindly contact Q'go Concierge at 1888125.

-

Umrah Package

Get a discount on the Umrah package from Q'go Concierge for 3 days starting from KD 180. To avail the offer, contact Q'go Concierge at 1888125.

-

Limo Ride Service

Enjoy a limo ride to the airport. To request the service, call Q'go Concierge or send a WhatsApp message on 1888125.

-

Extra Luggage

Contact Q'go Concierge and request extra luggage allowance when flying on Turkish Airlines.

-

Hotel Offers

Relax and book your special getaways with exclusive hotel offers including special rates, complimentary dining and more. To request these offers, contact Q'go Concierge.

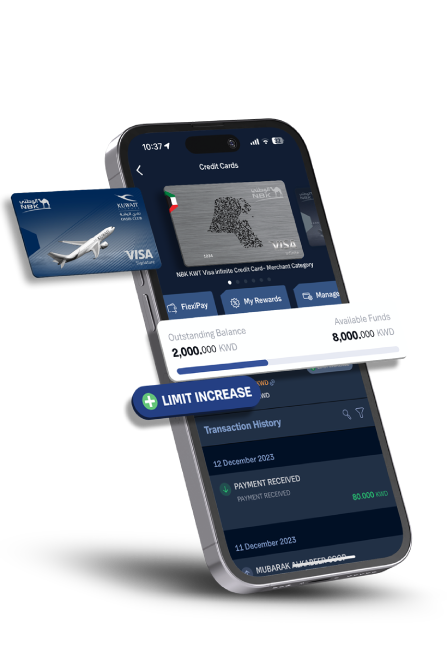

Enjoy

Various Benefits

With NBK Mobile

Banking

FAQs

Customer must meet one of the following criteria:

• A minimum monthly salary of KD 3,000 that must be transferred to NBK, if not already, for 3 consecutive months

• A deposit of KD 100,000 or more in any interest or non-interest bearing NBK Account including Al Jawhara Account, NBK Term Deposit or any investment funds by NBK for 6 consecutive months

You can find premium services lounges at branches situated in:

• NBK Headquarters

• Jabriya

• Ras Al-Salmiya

• Shamiya

• Al-Salam Mall

• Salmiya

• Ahmadi

• Kaifan

• Nuzha

• Daiya

• Ahmad Al-Jaber

• Fahad Al-Salem

• Faiha

• Rawda

• Hawalli

• Dahiyat Abdullah Al-Salem

• Mishref

• Qurain

• Surra

• Fahaheel Al-Sahely

• Al-Hamra Tower

• Cinema Al-Salmiya

• Al-Andalus

• Shuwaikh

• KOC

• Riqqa

The fast-track check-in service cost is KD 11.250.

Q'go Concierge verifies customer's eligibility by the first 8 digits of their debit card number.

Check out other Premium Concierge Services you can benefit from.

If the average salary, account or fund balance falls below the minimum required amount for three consecutive months, a monthly service fee of KD 50 will be deducted from the customer’s personal account at the bank or Privilege services will be discontinued.

Customer must meet one of the following criteria:

- Minimum monthly salary of KD 3,000 that must be transferred to NBK, if not already, for 3 consecutive months

- Deposit of KD 100,000 or more in any interest or non-interest bearing NBK Account including Al Jawhara Account, NBK Term Deposit or any investment funds by NBK for 6 consecutive months

Free For Life Cards

- Spend KD 10,000 or more using your NBK KWT Visa Infinite Credit Card, or KD 15,000 or more using your NBK Visa Infinite Credit Card and get your KD 100 annual fee waived

Eligible credit cards for all Privilege offers:

- NBK KWT Visa Infinite Credit Card

- NBK-Aura World Mastercard Credit Card

- NBK-Kuwait Airways Visa Infinite Credit Card

- NBK-Kuwait Airways Visa Signature Credit Card

- NBK-KPC Visa Infinite Credit Card

- Visa Infinite Credit Card

- Visa Signature Credit Card

- NBK Infinite Privilege

- World Mastercard Credit Card

Samsonite

- Customer will get 10% discount on all Samsonite products when purchasing in store only

- Customer must present NBK Privilege Debit Card and pay using their eligible NBK Credit Card

Q'go Concierge

- Customer must contact Q'go Concierge at 1888125 to avail the below offers

- Customer must pay using their eligible NBK Credit Card

Umrah Package:

- Umrah package for one person in a single room at Mövenpick Hotel & Residence Hajar Tower, Makkah or its equivalent for 3 days and 2 nights: starting from KD 275

- Umrah package for one person in a double room at Mövenpick Hotel & Residence Hajar Tower, Makkah or its equivalent for 3 days and 2 nights: starting from KD 180

Hotel Offers:

- Q'go Concierge will verify customer's eligibility by the first 8 digits of their debit card number to manage the customer's booking

- Offer is exclusively for Privilege customers

- All Privilege customers can benefit from the offer

Extra Luggage:

- Q'go Concierge will verify customer’s eligibility by the first 8 digits of their debit card number

- Q'go Concierge must issue the ticket and will implement 20% discount

- Offer is only applicable on Turkish Airlines, where customer will get 20% discount on all baggage, regardless of destination

- Offer is exclusively for Privilege customers

- All Privilege customers can benefit from the offer

Investment Advisory Services Disclaimer

For general circulation and promotional purposes only. Investments in financial markets may lead to capital losses. To read more about features and risks of investing, please visit www.nbkwealth.com.

I'm Interested

Thank YouFor Registering

An NBK Representative will contact you within 2 working days.

Find Us

Find Us 1801801

1801801