Thahabi

Discover Possibilities

With Thahabi

Take advantage of the premium services that add convenience and value to your busy lifestyle including a wide range of exclusive benefits and offers.

The 5 Pillars of Thahabi

Exclusivity

Exclusivity

Discover unmatched exclusivity with dedicated support, a Personal Banking Officer, premium services lounge, priority access and Premium Concierge Service.

Advantages

Advantages

Learn more about Thahabi Package advantages with Family Banking Services, global banking, the gym of choice program, EPP school tuition and a complimentary Business Banking Plus package.

Additional Benefits

-

Umrah Package

Get a discount on the Umrah package from Q'go Concierge for 3 days starting from KD 180. To avail the offer, contact Q'go Concierge at 1888125.

-

Premium Services Lounge

Enjoy the comfort of premium service lounges.

-

School Tuition Payments

Pay your child's school fees easily in installments with NBK FlexiPay.

-

Priority Access

Get priority access in customer service, financial transactions and while queueing at NBK Branches.

Manage Your Financial Needs

With a Personal Banking Office

Our Personal Banking Officers are available to assist you with financial planning, portfolio management, assessing your financial goals as well as advising you on products that best fit your needs.

Investment Products and Services

-

NBK Brokerage Services

Trade in regional and US stock market with comprehensive brokerage services and expert trading support.

-

Guided Investments

Access a range of global diversified investment plans built by our expert financial advisors.

Personalized Offers

Tailored to Your Lifestyle

Discover bespoke offers, tailor-made to match your unique preferences and interests.

Enjoy 10% instant discount when spending KD 10 or more at BACKBURNER’s store.

Terms and conditions apply

Enjoy 15% instant discount when shopping through OUNASS's website or app and using promo code NBK.

Terms and conditions apply

Get 10% cashback in NBK KWT Points when using NBK KWT Visa Infinite Credit Card at Zain.

Terms and conditions apply

Get 10% NBK Rewards Points upon spending KD 100 or more at Max & Co.

Terms and conditions apply

Enjoy 10% instant discount when spending KD 10 or more at BACKBURNER’s store.

Terms and conditions apply

Enjoy 15% instant discount when shopping through OUNASS's website or app and using promo code NBK.

Terms and conditions apply

Get 10% cashback in NBK KWT Points when using NBK KWT Visa Infinite Credit Card at Zain.

Terms and conditions apply

Get 10% NBK Rewards Points upon spending KD 100 or more at Max & Co.

Terms and conditions apply

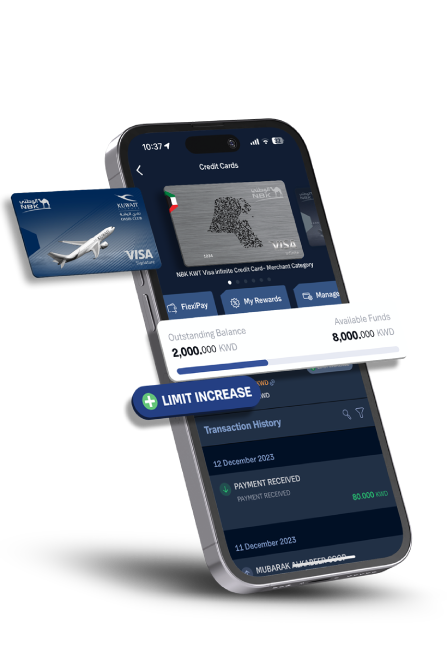

Enjoy

Various Benefits

With NBK Mobile

Banking

FAQs

Customer must meet one of the following criteria:

• A monthly salary between KD 1,500 to KD 2,999 that must be transferred to NBK, if not already

• A deposit of KD 30,000 or more in any interest or non-interest bearing NBK Account including Al Jawhara Account, NBK Term Deposit or any investment funds by NBK for 3 consecutive months

You can find premium services lounges at branches situated in NBK Headquarters, Jabriya, Ras Al-Salmiya, Shamiya, Al-Salam Mall, Salmiya, Ahmadi, Kaifan, Nuzha, Daiya, Ahmad Al-Jaber, Fahad Al-Salem, Faiha, Rawda, Hawalli, Dahiyat Abdullah Al-Salem, Mishref, Qurain, Surra, Fahaheel Al-Sahely, Al-Hamra Tower, Cinema Al-Salmiya, Al-Andalus, Shuwaikh, KOC and Riqqa.

Check out other Premium Concierge Services you can benefit from.

Q'go Concierge verifies customer's eligibility by the first 8 digits of their debit card number.

If the average salary, account or fund balance falls below the minimum required amount for three consecutive months, a monthly service fee of KD 25 will be deducted from the customer’s personal account at the bank or Thahabi services will be discontinued.

Customer must meet one of the following criteria:

- Monthly salary between KD 1,500 to KD 2,999 that must be transferred to NBK, if not already

- Deposit of KD 30,000 or more in any interest or non-interest bearing NBK Account including Al Jawhara Account, NBK Term Deposit or any investment funds by NBK for 3 consecutive months

Eligible credit cards for all Thahabi offers:

- NBK KWT Visa Infinite Credit Card

- NBK-Kuwait Airways (Oasis Club) Visa Signature Credit Card

- NBK Visa Signature Credit Card

- NBK World Mastercard Credit Card

American Tourister

- Customer must present their NBK Thahabi Debit Card and pay using any of the eligible NBK Credit Cards at American Tourister stores

- Discount is applicable on sale items in addition to full price items

Q’go Concierge

- Customer must contact Q’go Concierge at 1888125 to avail the offer

- Customer must pay using an eligible NBK Credit Card

Umrah Package:

- Umrah package for one person in a single room at Mövenpick Hotel & Residents Hajar Tower, Makkah or its equivalent for 3 days and 2 nights starting from KD 275

- Umrah package for one person in a double room at Mövenpick Hotel & Residents Hajar Tower, Makkah or its equivalent for 3 days and 2 nights starting from KD 180

Investment Advisory Services Disclaimer

Investments in financial markets may lead to capital losses. To read more about features and risks of investing, please visit www.nbkwealth.com.

I'm Interested

Thank YouFor Registering

An NBK Representative will contact you within 2 working days.

Find Us

Find Us 1801801

1801801